We get it…it’s SO frustrating.

You have had a hail repair specialist look at your car, and they’re saying you’re looking at $7,000 to $8,000 in damage. You then send the photos to your insurance adjuster, but their estimate comes in at $980.

“What the heck?” you’re thinking. “How am I going to get this thing fixed?”

We hear it all the time.

What’s causing this is the fact that hail damage on cars is difficult to see, whether in person or via photos/virtual meetings.

So how do you actually solve hard to see hail damage on car?

Jump To:

-> What to Know About Car Insurance Photo Inspection

-> How to Take Pictures to Show Hard-to-See Hail Damage on Cars

Hail damage—like any other type of car damage—must be fixed ASAP, especially since it can further devalue your car if it’s not repaired for a while.

However, if it’s hard to see the hail damage on your car, how can you know exactly how much it will cost to repair it?

In this article, we’ll show you how, and it starts with the changes in insurance inspection that often asks for photos to provide an estimate of the damage.

What to Know About Car Insurance Photo Inspection

A crucial requirement involved in fixing different types of hail damage—including collision, paint, and other serious forms of car damage—is having a clear picture of the situation. Even though you may only be dealing with minor hail damage, it still needs to be assessed properly to ensure an accurate estimate of repair costs and time.

Since the pandemic, though, adjusters now rarely come out to do hail repair estimates at your home or office as they used to in years past.

If you’ve recently filed a claim for one of the many hail storms in Colorado Springs, Greeley, etc. last year, you’ve probably heard an adjuster ask you to “send photos.”

We are getting tons of calls from frustrated customers wondering if their insurance adjuster will be able to see the hail damage in photos, especially if there are a ton of hard-to-see dents to assess. They’re also asking what to do when the estimate comes in REALLY low.

When it comes to a car insurance photo inspection, it’s really difficult for adjusters to see the hail damage in most photos.

But the good news is that if the estimate comes in crazy low, we simply send what’s called a “supplemental estimate” (aka supplement) up to the adjuster, which outlines all the damage he/she missed on the initial estimate.

It was already an extremely common thing before this year, but the fact that adjusters simply aren’t going out to look at hail-damaged cars in person has made supplements even more prevalent today.

However, there are things you can do to take better pictures that help adjusters spot hard to see hail damage on your car!

Below are some of our tips and tricks on taking pictures for insurance claims to get an accurate estimate of hail damage, even on the hard-to-see dents:

How to Take Pictures to Show Hard-to-See Hail Damage on Cars:

Tip #1: Point to the Damage

This is a straightforward way to show the adjuster exactly what you’re looking at in-person. Sometimes, people take a photo and think the adjuster will just “know” what it is they’re looking at—more often than not, that’s NOT the case.

Tip #2 Photograph Broken or Dented Parts, Before You Replace Them

This seems like a no-brainer, but definitely take photos of broken or dented parts before replacement or repair is done.

Sometimes, people need to replace broken parts to make the car drivable, like the tail lights or windshield.

If you have to replace these items BEFORE you get a photo-based estimate from your insurance, ensure you have pictures of the broken parts in the car showing damage!

Also, be sure you save any receipts for items you purchase, as you can be reimbursed for those items.

Your insurance might say something like, “well, your deductible is $500, and since the windshield is $450, we are just going to count that toward the expense of the deductible.”

Here’s the thing about that.

StormWise can waive a deductible*. So what does that mean to the purchased items that your insurance said would go towards your deductible?

Save your receipts, and StormWise will reimburse you for the cost you’ve already put into repairing the broken parts.

So, in this case, the insurance estimate will include the $450 it costs to replace that windshield, which means StormWise will receive payment for it.

That’s how we can reimburse you directly from the insurance proceeds for your out-of-pocket cost to make the car drivable.

Tip #3: Use the Proper Angles

This is one that most people won’t know because it’s not super intuitive.

Basically, you can’t look directly down at the panel – the dents will be washed out, and you won’t be able to see very many of them.

When you look at the dent head-on and take a photo of it, you can’t get an idea of its true size.

You have to be looking perpendicular to the panel:

For example, kneel down when taking pictures of the hood.

Look down the side of the door to see damage on the door panels.

And don’t forget to point to the damage (without covering the dent with your finger) when taking photos.

Tip #4: Use Indirect Lighting

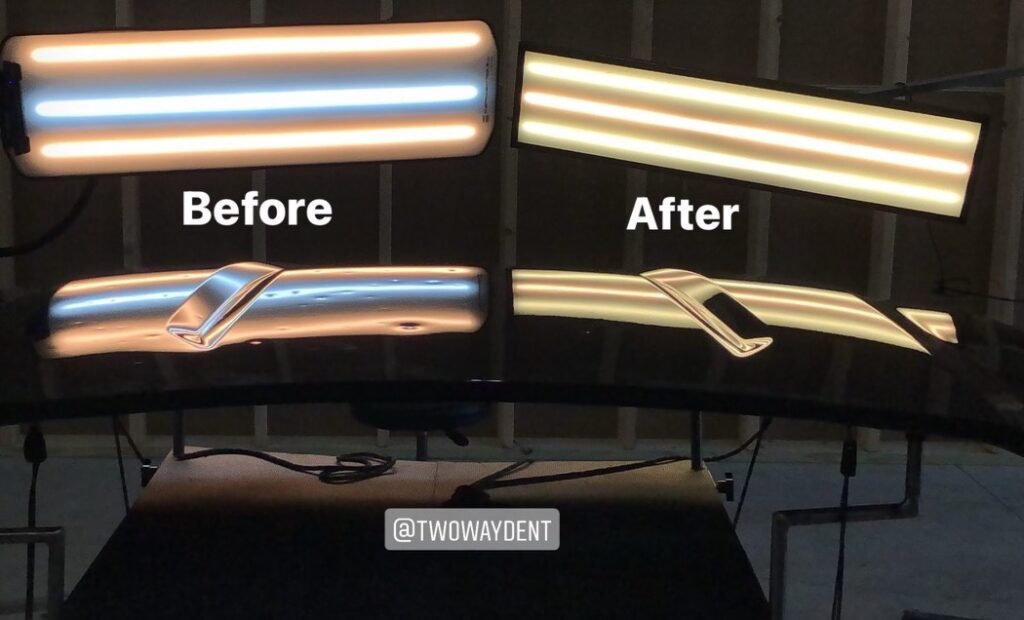

The sun isn’t always your best friend when it comes to revealing hard to see hail damage on car. In most cases, it really is better to use another light source. When your hail damage is fixed using paintless dent repair, you’ll see that the technicians use specialized lighting to see the true size and depth of the dent.

You’ll also notice that they are usually working in a garage that doesn’t have a ton of other natural light shining through. Because bright sunlight will wash out the full scope of the dent, and you won’t be able to see anything in photos.

So don’t take photos in the middle of the day when the sun is blaring. The soft lighting during dawn and dusk and really cloudy days will help adjusters spot hail damage on a car.

Your best bet for taking pictures for insurance claims on hail damage is to do it in a garage.

If you don’t have a garage, take photos under a gas station overhang at least, so the dents are not washed out by bright lights.

One Step Further: Get in a Garage and Use a Flashlight

You can mimic the specialized lighting that PDR technicians use by placing a flashlight behind the car as you look into it.

When you take photos with a flashlight pointing behind the panel, the pictures can reveal tiny dents on the panel that would otherwise not be seen.

If you don’t have a flashlight (but you have a garage), try turning a light on inside the house and cracking the door that enters the garage to create a long skinny line that you can take photos of and use various angles to show the bend in the metal.

Tip #5: Circle the Damage using a Specialized Auto-Safe Marker

Circling the dents is one of the main ways we ensure adjusters get the right dent counts on each panel!

Be sure to use a Washable Window Marker to circle the hail damage on your car – so you can wash off the dent marks afterward.

When getting a washable marker, choose a contrasting color to the paint color of the car, i.e., you wouldn’t want to use a red marker on a red car, you’d want to use a yellow marker so the circles can be seen.

Circle every single dent and broken part on your car and take pictures using the tips above.

This is one of the sure-fire ways your adjuster will be able to see the damage.

Afterward, you can go through a car wash to clear the marks. If you have a few circles that remain, simply use a clean microfiber car-safe towel and some Windex to get them off.

Special Note: do NOT leave the circles on the car and drive it around for days. Not only does that look super tacky, but it can also burn into the clear coat of the paint on some car types and leave circles you can only get off by having the car professionally buffed out!

One critical thing to keep in mind is that, ultimately, the estimate your adjuster gives you may still be lower than what it needs to be. The repair shop will need to supplement it.

It shouldn’t be a big deal. We at StormWise do this all year round, so we’re very well-versed in the supplement process for all major insurance companies.

StormWise has written approved estimates for insurance companies like:

- The Hartford

- State Farm

- Geico

- Many others!

Those insurance companies will approve the supplement just based on what we write, and there won’t be an outside adjuster assigned to audit the supplement.

We hope that these tips and tricks on how to solve hard to see hail damage on your car have helped you! Try not to stress out about it if adjusters send back some extremely low estimate.

Contact us today, and we’ll make sure 100% of the damage can be seen by the adjusters, and covered on the estimate. Then, we’ll restore your car in a timely fashion (1 to 2 weeks on average) before giving it back.

*Deductible coverage: Ask your sales rep about what we can cover for your deductible. The amount varies depending on factors including car models & years and insurance details.

Auto hail

repair

Auto hail

repair

Hail

damage cost calculator

Hail

damage cost calculator  Before/After

Before/After

PDR cost

101

PDR cost

101

About

StormWise

About

StormWise

reviews

reviews  Articles

Articles  FAQs

FAQs

resource & contact

resource & contact